The Launch Pad brings you innovative ideas and insights from experts and service providers from across the automotive industry. Our goal is to help dealerships find the next big thing to launch their dealership to success.

This week on The Launch Pad, Ed Maisonneuve, President and Co-founder of StipTrac, shows you how technology can streamline the loan delivery process for customers and dealerships.

The auto industry is constantly being told to change. Do this or do that and you will improve sales or service business. Websites, CRMs, DMSes and even reconditioning programs are constantly being pushed to help increase the bottom line. The only thing that has never changed is the delivery process and how we track our contracts in transit. But consumers are changing how they buy and what they expect. Are you changing with them?

StipTrac is the first ever Automotive Loan Management System specifically designed for dealerships to change their delivery process. Cash flow is an important topic for the dealership but has never been communicated well companywide even though many different people can influence it and have their “hands” on it. StipTrac will assist dealers in tracking “true” contracts in transit (the minute it is considered a deal and the customer has agreed to buy it, it is a contract) at this point it is in as a contract in transit, collecting necessary items, and keeping an open communication line with the consumer before and after their purchase as well as among the employees who do influence your cash flow.

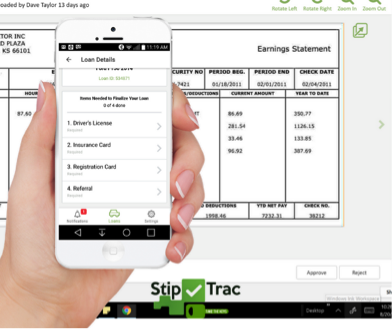

The StipTrac dashboard will help dealers see their contracts in transit at a glance, including which bank has it and who sold that vehicle. StipTrac is the who, what, where, when and why of every car that is on the street.

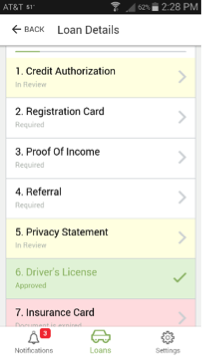

StipTrac’s consumer mobile app Take the Keys allows the consumer who has spent most of their time researching and educating themselves about the vehicle on their smartphone to continue to use their smartphone to finish the delivery process. This also allows the dealership to confidently collect needed items and deliver the vehicle. Consumers spend upwards of 4 or more hours during the selection and negotiation process and still wait to get in the business office. Take the Keys resets that clock for the consumer giving them the feeling that you care about their security and identity by going digital for their needed items.

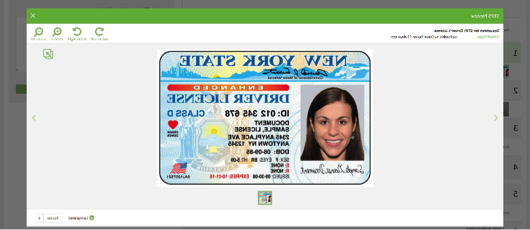

StipTrac allows for the dealership to approve or reject needed items and save the consumer from driving back and forth bringing missed/misplaced items that are needed to finalize a loan. At the same time, it is notifying the consumer that the needed item is correct or not, allowing them to see the process as well and creating transparency at the dealership.

Some of the key features of StipTrac will allow dealer employees to add additional items to a loan at ANY time. Plus, it allows dealers to gain real references and referrals from customers, allowing customers to use their “contact list” on their cell phone to refer people. Stiptrac also allows the dealership to send automatic push notifications at any time and logs when customers have read that message. Take the Keys still works even if the consumers mobile device has been disconnected by the carrier. The smartphone simply works off of wifi for the consumer. It also helps protect them from identity theft by allowing them to safely and securely submit items through a highly encrypted system.

The ability for employees to communicate efficiently means everyone who influences your cash will be aware of the status and process of every vehicle, making sure no vehicles slip through the cracks. StipTrac has internal notes that allow everyone to be in the know. The traditional/antiquated Excel or handwritten contracts in transit list is eliminated, just look in the system and everything is there by name, amount and days.

Ed Maisonneuve states “StipTrac is a needed tool to improve the automotive loan delivery process for car dealerships and consumers. Using StipTrac removes a lot of the stress that today’s dealerships are facing. We built StipTrac so the delivery process and the contracts in transit are truly all in “Real Time”. As a finance manager I can’t tell you how many times a deal came into my office with missing documents, bad references, missing signatures…you get the point! StipTrac 100% eliminates that. Sometimes things come up and we needed additional documents to get the loan funded. The major problem is that people are busy living their day to day lives. The last thing they want to do is go back to the dealership. Most of the time we would call and get a “I’m sorry this person has a voice mailbox that has not been setup yet” or mailbox full or disconnected…two to three days go by without any response from the customer or worse the customer is texting pictures to their salesman’s cell phone exposing the dealership to privacy laws. We believe that keeping an open and safe line of communication between the car dealership and the consumer is the fastest and most effective way to get an automotive loan funded so dealers can stay focused on selling cars.”

Ed Maisonneuve is the President and co-founder of StipTrac.

Ed Maisonneuve is the President and co-founder of StipTrac.

Ed focuses time on marketing and sales strategies. He is no stranger to the automobile industry, having spent over 20 years as a retail salesman and a finance manager. Ed has seen and adapted to many changes in the automobile industry over the years. Ed’s background in the automobile industry has provided the perfect foundation for understanding the dealership owner’s pains and finding solutions for those pains.

To contact Ed, please email ed@stiptrac.com or visit www.MyStipTrac.com